Gold Etf Investment Procedure

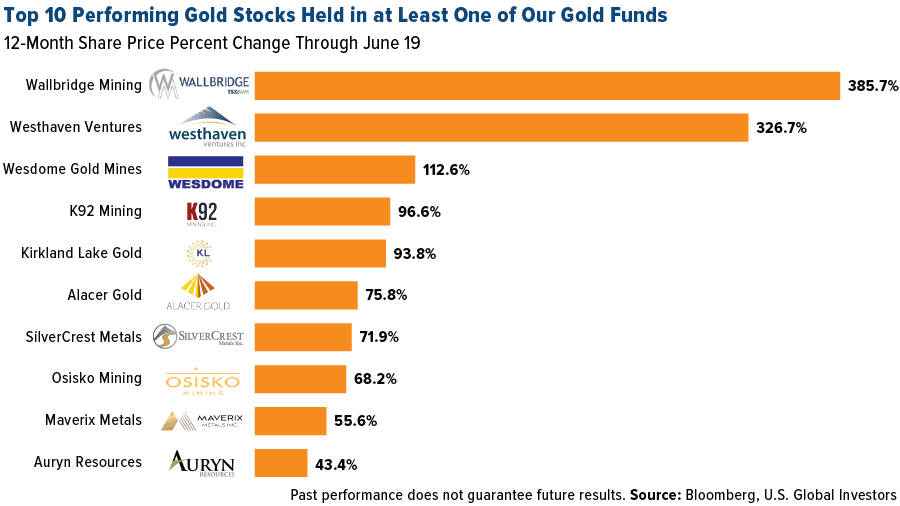

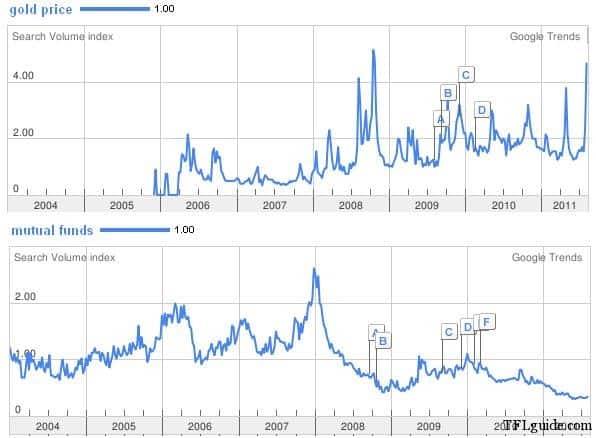

Some gold etfs directly track the price of gold while others invest in companies in the gold mining industry.

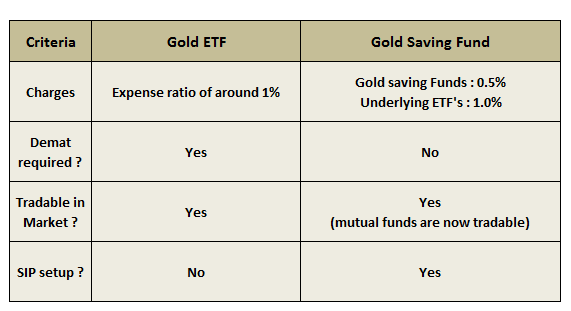

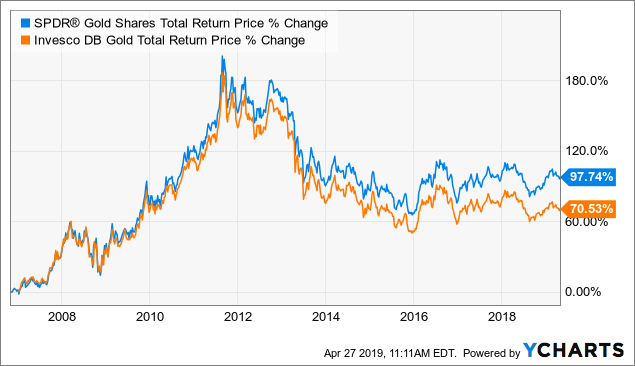

Gold etf investment procedure. 0 40 or 40 annually for every 10 000 invested the spdr gold shares gld 178 70 is the first u s traded gold etf and as is the case with. Gold etfs are the same as mutual fund units where each unit is equivalent to one gram gold though some funds give the option to invest in lower denominations of 0 5 gram as well. Three of the largest etfs include spdr gold trust. Etfs that own gold.

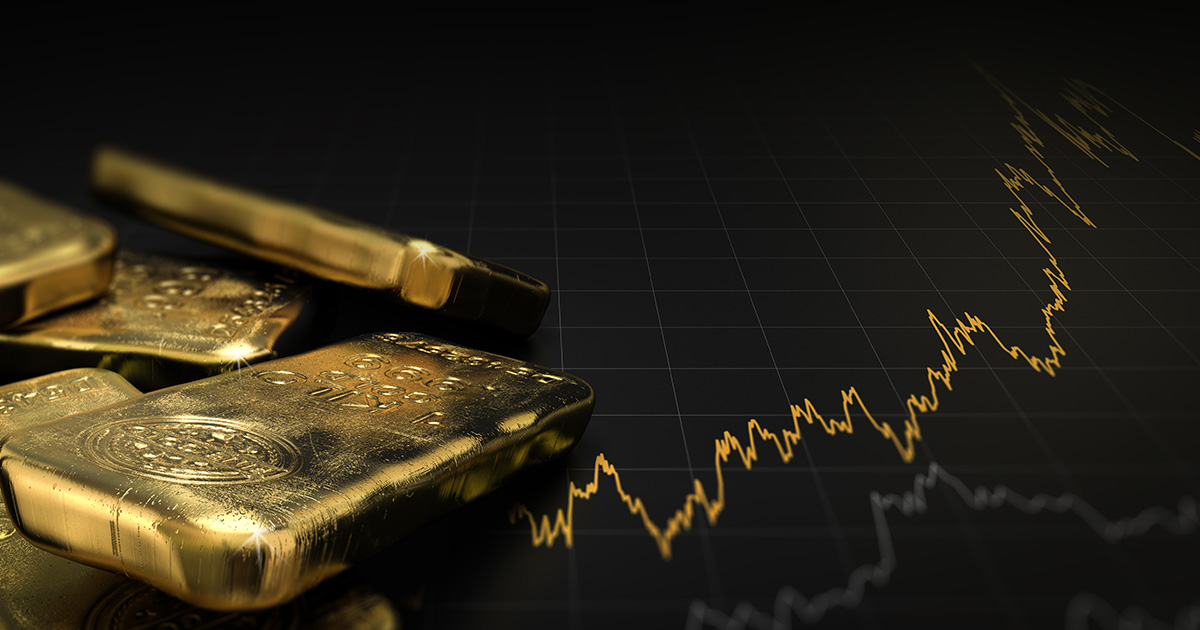

But this etf is the better option today. As with other types of etfs the issuing company buys stock in gold related companies. When it comes to investing in gold there are two main ways to do it buy physical gold or invest through an exchange traded fund etf although the etf route comes with an annual expense ratio. If you don t want the hassle of owning physical gold then a great alternative is to buy an etf that tracks the commodity.

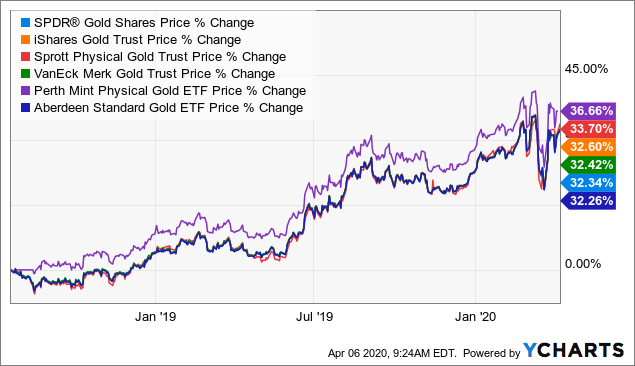

Thinking about investing in gold. Gold exchange traded funds etfs are a more convenient and cost effective means of investing in gold stocks especially for those who lack the inclination or time to research specific gold. There are currently 9 etfs focused on tracking the price of gold excluding leveraged or inverse funds. Why this gold etf is a better buy than gold mining stocks gold and the companies that mine for it have had an incredible run.

The price of gold increased by 39 2 in the past year significantly exceeding the. The largest gold etf the spdr gold shares etf for example has an expense ratio of 0 40.